arkansas estate tax return

Individual Income Tax Section PO. If you choose to electronically file your State of Arkansas tax return by using one of the.

Income Tax Department Of Finance And Administration

Direct Deposit is available for Arkansas.

. Identity Theft has been a growing problem nationally and the Department is taking additional measures to ensure tax refunds are issued. Box 1000 Little Rock Arkansas 72203-1000. State Income Tax PO.

State Income Tax PO. Arkansas Estate Tax Return. Mail Refund Returns to.

Generally the estate tax return is due nine months after the date of death. A six month extension is available if requested prior to the due date and the estimated correct amount of tax is paid. AR1000F Full Year Resident Individual Income Tax Return.

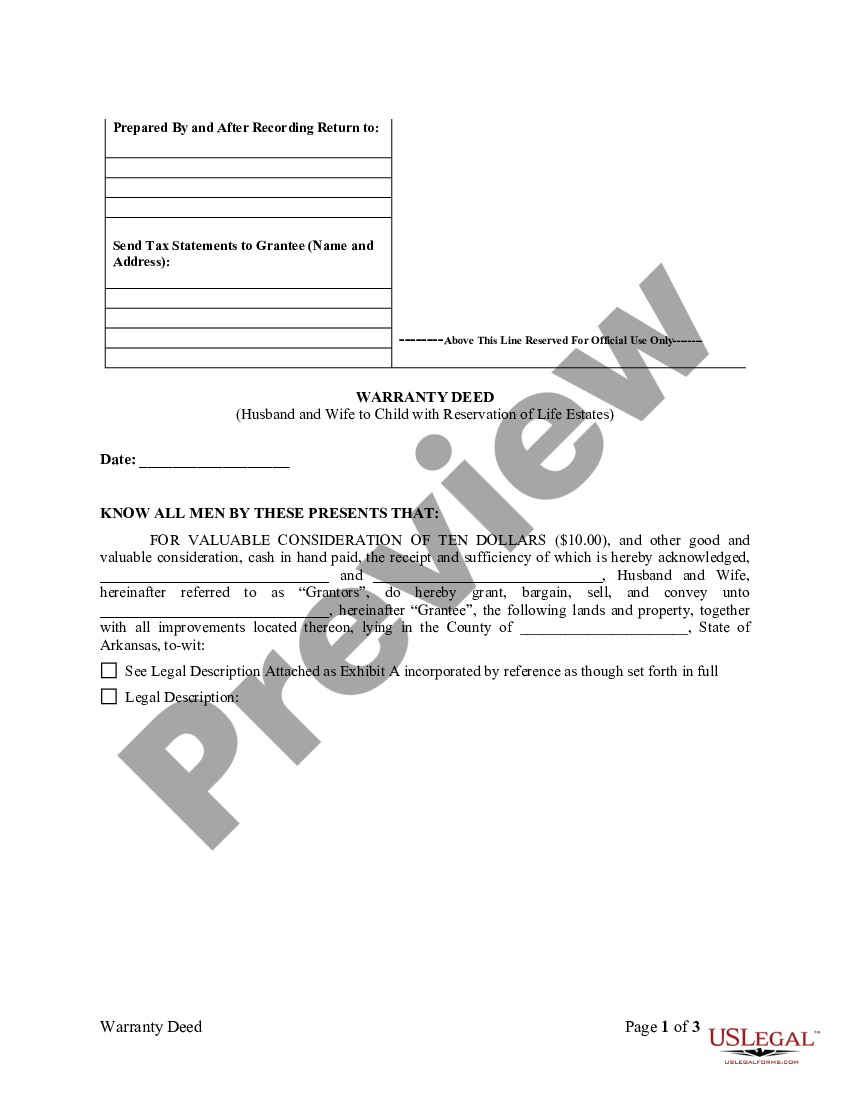

Check your refund status at. Arkansas Estate and Inheritance Tax Return Engagement Letter - 706 US Legal Forms offers access to the largest collection of fillable forms in Word and PDF format. One 1 copy of the approved request must be attached to the return when filed.

Box 3628 Little Rock AR 72203-3628 WHERE TO MAIL Mail Tax Due Returns to. Little Rock AR 72203-3628 If you owe tax make your check or money order payable to Department of Finance and Administration. Processes examines and audits C -corporation and Sub-S income.

AR1000NR Part Year or Non-Resident Individual Income Tax Return. An estate administrator must file the final tax return for a deceased person separate from their estate income tax return. Filing Income Tax Returns to.

Filing Income Tax Returns to. Box 3628 Little Rock AR 72203-3628 WHERE TO MAIL Mail Tax Due Returns to. Approved Federal extension is not valid for Arkansas purposes although copy of the Federal Form may be substituted to the Department of Finance and Administration for approval in lieu.

Important Information for Taxpayers using Online Web Providers to eFile for State Filing. Preparation of a state tax return for Arkansas is available for 2995. Interest on unpaid Arkansas Estate Tax accrues at ten percent 10.

This tax is item 5 on the Arkansas Estate Tax Return Form. The types of taxes a deceased taxpayers estate. The Corporation Income Tax Section provides technical assistance to corporate customers CPAs and other tax preparers.

Box 2144 Little Rock Arkansas 72203-2144. Mail Tax Due Returns to. Upon receipt of a copy of the Federal closing letter the State of Arkansas will issue an Arkansas estate closing letter.

Be sure to write your Social Security Number and. E-File is available for Arkansas. The fact that Arkansas has neither an inheritance tax nor an estate tax does not mean all Arkansans are exempt when it comes to tax consequences as part of an estate plan.

State Income Tax PO. Individual Income Tax Section PO. In the case of the estate of a resident or a non-resident who dies having real property anor tangible.

State Income Tax PO. Documents estate tax returns and fiduciary income tax.

33 States With No Estate Taxes Or Inheritance Taxes Kiplinger

Arkansas Estate Tax Everything You Need To Know Smartasset

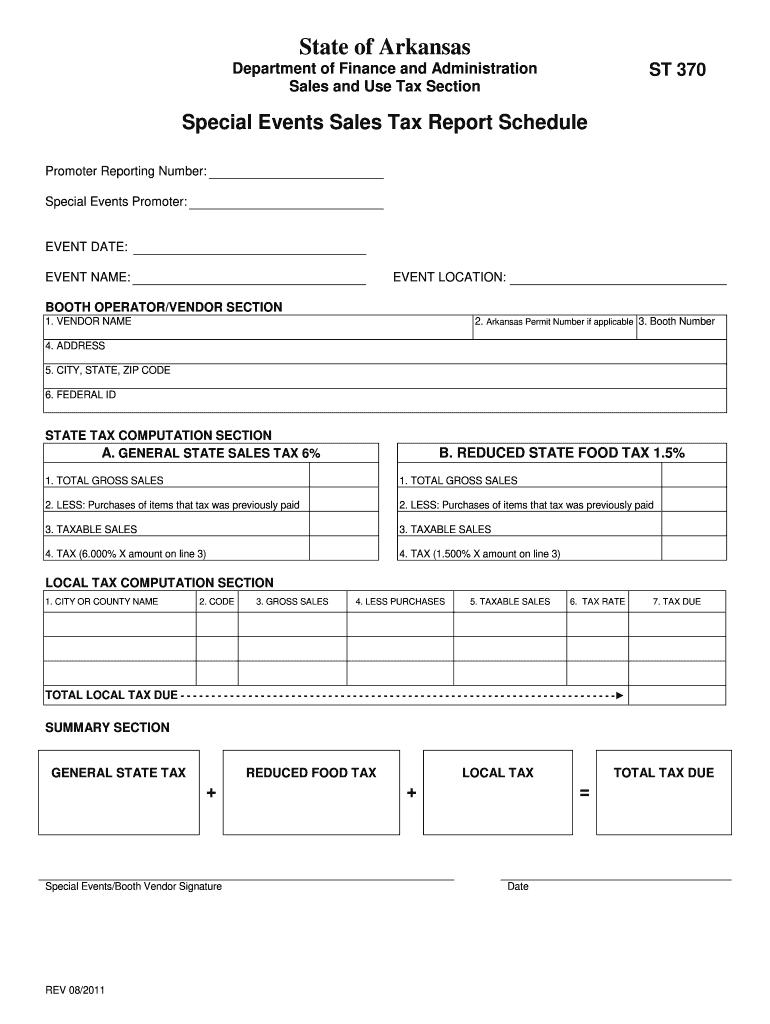

Arkansas St370 Form Fill Out Sign Online Dochub

Arkansas Estate Tax Everything You Need To Know Smartasset

Arkansas Warranty Deed For Parents To Child With Reservation Of Life Estate Us Legal Forms

State By State Estate And Inheritance Tax Rates Everplans

Tax Relief Available For Arkansas Illinois Kentucky And Tennessee Tornado Victims Kiplinger

Creating Racially And Economically Equitable Tax Policy In The South Itep

Transfer On Death Tax Implications Findlaw

Free Arkansas Tax Power Of Attorney Form Pdf Eforms

Learn More About Arkansas Property Taxes H R Block

![]()

Homestead Tax Credit Real Property Aacd

Arkansas Inheritance Laws What You Should Know Smartasset

Is There An Inheritance Tax In Arkansas

1099 G Arkansas Fill Out Sign Online Dochub

Estate Planning Law Firm Wills Trusts Probate Arkansas